The Koojan project is a joint venture between Lachlan Star Limited (45%), Minerals 260 Limited (30%) and Wavetime Nominees (25%), where Minerals 260 are the operating manager of the joint venture. The project is located in the New Norcia region of Western Australia and approximately 80 kilometres north of the recent Julimar Ni-PGE-Cu discovery by Chalice Mining Ltd.

The project is situated within the Western Gneiss Terrain of the Archean Yilgarn Craton of southwest Western Australia and contains prospective mafic-to-ultramafic bodies, hosted within the Jimperding Metamorphic belt. The geological setting is interpreted to be comparable to the host rocks of the Julimar discovery.

The project is actively being explored for copper, nickel, cobalt and PGE mineralisation potential, within a region that has seen minimal historic exploration activity.

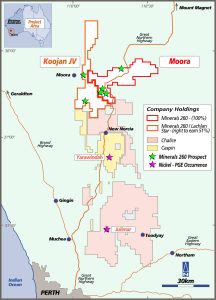

Reference https://minerals260.com.au/moora-and-koojan-jv-projects/ Figure 1: Location and regional tenement plan

Minerals 260 (ASX:MI6) Farm-in JV

As announced 10 August 2021, Minerals 260 Limited (MI6) can acquire 51% equity in the Koojan Project by spending a total of $4 million on exploration within 5 years, with a minimum expenditure commitment of $500,000 before having the right to withdraw. Upon MI6 earning 51% in the Koojan JV Project, the parties respective interests will be MI6 (51%), Lachlan Star (24%), Wavetime Nominees (25%).